You purchased your “forever home,” but now your employer wants to transfer you to another office in a different state. With years left to pay on your mortgage, you need to know your options for relocating. If taking on a second mortgage isn’t in the cards, don’t worry, here’s how you can sell your home with a mortgage.

Calculate exactly how much you owe

Don’t panic, most sellers have a mortgage on their home, you just need to do the math to make sure you walk away free and clear. The first thing you need to do is find out your mortgage payoff amount. Many people often confuse their monthly current balance total for the amount they owe on their current mortgage, but you need to contact your lender directly to find out the total you’ll be responsible for paying off the loan amount.

Because you planned on this being your forever home, you may have taken a loan from a lender who charges mortgage prepayment penalties (as though paying off your loan debt early is a bad thing).

A quick phone call to the bank will let you know the exact number you need to pay off your current mortgage amount, taking into account any interest and fees.

Determine how much you can realistically sell your home for

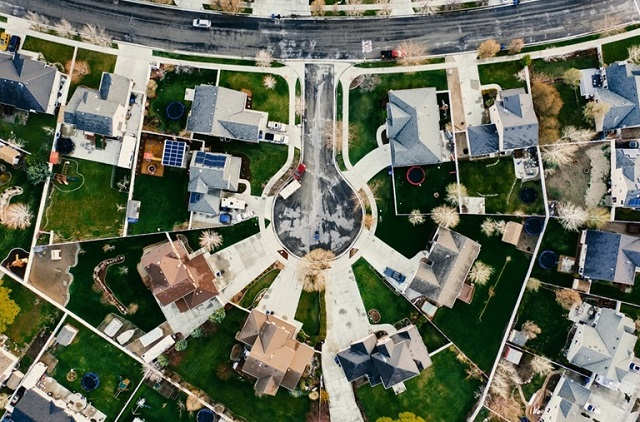

Now that you know what your mortgage payoff amount is, you need to determine the price you can command when you sell your house. This is where it pays to find a talented and knowledgeable real estate agent because they will conduct a comparative market analysis — using the sale prices of similar homes in your neighborhood — to determine your house’s current market value.

Put your math skills to the test. With a solid number to use as a sale price, you now need to figure out what you will be making from the sale of your home. A down and dirty number will simply be the amount of your home sale price, minus your mortgage payoff amount. The remaining number will be your profit, and how much you can roll into a downpayment on your next home if you’re planning to buy again.

If you want to deep dive into your calculations, further subtract the amount of your downpayment and closing costs on your current home to accurately determine how much you’ll make from the sale of your home.

The numbers may not be in your favor

Don’t be surprised if you don’t profit from the sale of your home, especially if you’ve only lived in your home for a short time. Prepayment penalties and static home values can often leave you leaving that original downpayment on the table, especially if you sell after owning your house for less than five years.

Another scenario to steel yourself for is the possibility that you paid more than your house is currently worth when you originally purchased. Many different factors can lead to soaring home prices, leaving people with mortgages in excess of their home’s actual value when the real estate market bottoms out.

While this scenario is rare these days, there is the possibility that your home sale will not pay off your mortgage amount, leaving you to pull from personal funds to satisfy the remaining balance.

Don’t forget the property taxes

Once you have a settlement date, check with your local taxing authority to find out how much you owe, if anything, in real estate taxes to-date. If your municipality sends quarterly property tax bills, you may need to contact them to get a pro-rated amount; you’re responsible for those taxes up until your settlement date.

In some areas, homeowners prepay their property taxes each year, making them eligible for a refund when they sell their home.

Selling your home with a mortgage is definitely possible and isn’t a major hassle, as long as you’re prepared. Make sure to crunch the numbers to optimize your profit, ensuring a healthy downpayment on your next “forever home.”

This post was last modified on March 31, 2020 9:20 AM